Strategy

An Innovative Approach to Managing Downside Risk

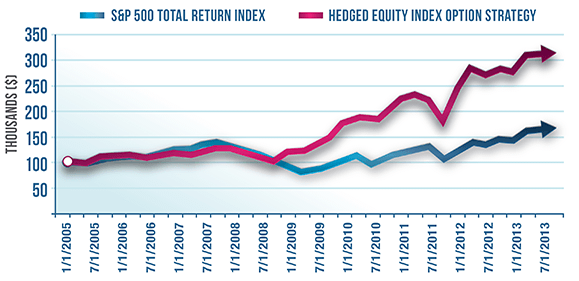

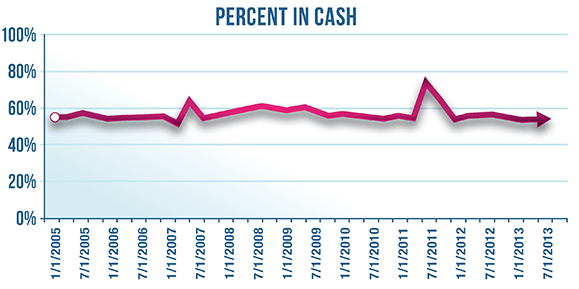

A severe market decline can have a devastating effect on your portfolio, making it difficult to recapture losses incurred on long-term savings. Constructing a portfolio using tail risk hedging can help to minimize the impact of adverse market movements. The Hedged Equity Index Option Strategy seeks to outperform the S&P 500 over the long-term, while hedging downside risk with Volatility Index (VIX) options.